Covid-19 Aid & Information

SBA Disaster Assistance in Response to the COVID-19

Coronavirus (COVID-19)

Coronavirus (COVID-19)

Small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to Coronavirus (COVID-19). Click Here for additional information.

This information is from the US Government Small Business Administration website and is provided to you as a business and public service from the Heart of Vermont Chamber of Commerce

IMPORTANT NOTE: If the links on this resource page do not link directly to the internet, simply cut and paste the link you want to go to into your browser.

SBA Disaster Assistance in Response to the COVID-19

Coronavirus (COVID-19)

SBA Disaster Assistance in Response to the Coronavirus

Content

Areas eligible for SBA disaster loans

Economic Injury Disaster Advance Loan

Other Coronavirus Assistance

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Upon a request received from a state’s or territory’s Governor, the SBA will issue under its own authority, as provided by the Coronavirus Preparedness and Response Supplemental Appropriations Act that was recently signed by the President, an Economic Injury Disaster Loan declaration.

Any such Economic Injury Disaster Loan assistance declaration issued by the SBA makes loans available statewide to small businesses and private, nonprofit organizations to help alleviate economic injury caused by the Coronavirus (COVID-19). This will apply to current and future disaster assistance declarations related to Coronavirus.

The SBA’s Office of Disaster Assistance will coordinate with the state’s or territory’s Governor to submit the request for Economic Injury Disaster Loan assistance.

Once a declaration is made, the information on the application process for Economic Injury Disaster Loan assistance will be made available to affected small businesses within the state.

The SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance and can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%. The SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

The SBA’s Economic Injury Disaster Loans are just one piece of the expanded focus of the federal government’s coordinated response, and the SBA is strongly committed to providing the most effective and customer-focused response possible.

For questions, please contact the SBA disaster assistance customer service center at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov.

Areas eligible for SBA disaster loans

Small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to Coronavirus (COVID-19).

Economic Injury Disaster Advance Loan

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application. This loan advance will not have to be repaid.

Apply for the Loan Advance here.

Other Coronavirus Assistance

Due to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are currently eligible to apply for a loan advance of up to $10,000.

The SBA provides a debt relief to small businesses as they overcome the challenges created by this health crisis.

What to click on to get to fill out the SBA loan

GO TO: https://www.sba.gov/funding-programs/disaster-assistance

DISASTER ASSISTANCE

GO TO: https://www.sba.gov/disaster-assistance/coronavirus-covid-19

GO TO: https://covid19relief.sba.gov/#/

FILL OUT AND SUBMIT DISASTER LOAN ASSISTANCE FORM:

NOTE requirements for filling out this form:

SBA is collecting the requested information in order to make a loan under SBA’s Economic Injury Disaster Loan Program to the qualified entities listed in this application that are impacted by the Coronavirus (COVID-19). The information will be used in determining whether the applicant is eligible for an economic injury loan. If you do not submit all the information requested, your loan cannot be fully processed.

The Applicant understands that the SBA is relying upon the self-certifications contained in this application to verify that the Applicant is an eligible entity to receive the advance, and that the Applicant is providing this self-certification under penalty of perjury pursuant to 28 U.S.C. 1746 for verification purposes.

The estimated time for completing this entire application is two hours and ten minutes, although you may not need to complete all parts. You are not required to respond to this collection of information unless it displays a currently valid OMB approval number.

NOTE: Areas eligible for small business loans

https://www.sba.gov/disaster-assistance/coronavirus-covid-19#section-header-1

Click on apply for a loan advance:

/Disaster assistance/Coronavirus (COVID-19)

National Endowment for the Arts

COVID-19 Resources

https://www.arts.gov/covid-19-resources-for-artists-and-arts-organizations

Alternate Roots

https://alternateroots.org/covid-19-resource-page/

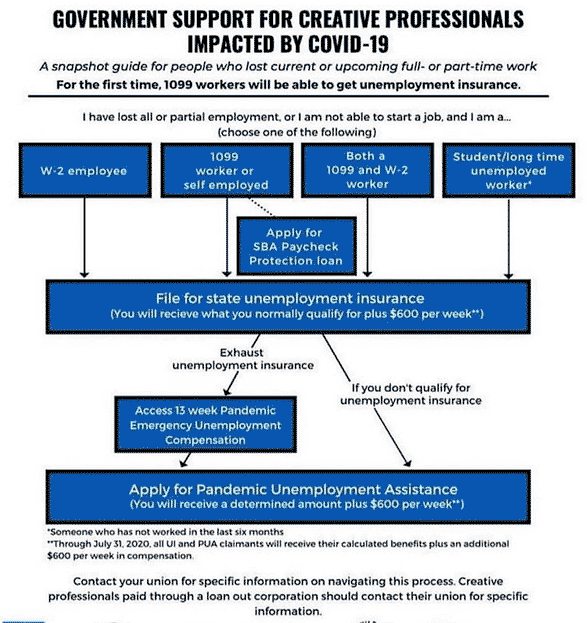

This page contains a diagram of alternate routes and resources for assistance.

Read for: important information about families first paid leave, unemployment benefits, small business disaster relief, and access to federal funding that supports workers in the gig economy, such as self-employed artists to find relief amidst the COVID-19.